1. COURSE DESCRIPTION

The professional roles of Bachelor of Accounting and Finance graduates will require students to be exposed to the use of accounting software applications to optimize business development, operations, auditing and analysis for various decision-making activities and processes. This course aims to teach the functional use of QuickBooks, a commonly used accounting software in many business organizations.

2. REASON FOR THE COURSE

This course aims to offer students a foundation in functional use of the most commonly used accounting software in Cambodia (i.e., QuickBooks) and an understanding of how to use other software solutions in a cloud environment (including the risks and controls) by using QuickBooks as an example. Research has shown that nearly 50% of companies in Cambodia are using QuickBooks. Therefore, it is advantageous for students to develop their technical skills and familiarize themselves with the software. Moreover, the function and structure of QuickBooks will provide applied knowledge for students to gain familiarity with the application and capacity of other accounting software. This course emphasizes recording transactions and generating accounting reports so as to strengthen their financial accounting knowledge.

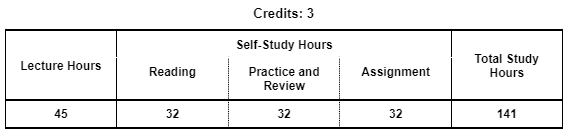

3. STUDY HOURS

4. ROLE IN CURRICULUM

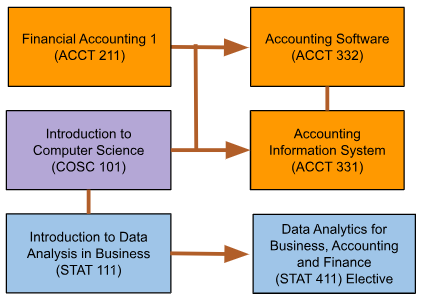

Prerequisites:

Introduction to Computer Science (COSC 101) and Financial Accounting 1 (ACCT 211) are prerequisites for this course.

On successful completion of this course, students will be able to:

| Knowledge | Level of Learning | Related PLO |

|---|---|---|

| Explain Cloud Computing and Cloud Accounting (CK1) Explain the primary information flows and needs within a business organization in relation to the industry shift towards Cloud Computing and Cloud Accounting. |

Understand | PK1 |

| Describe the basic steps of recording business transactions (CK2) Describe the basic steps of recording business transactions and preparing financial statements in QuickBooks. |

Understand | PK2 |

| Cognitive Skills | Level of Learning | Related PLO |

| Evaluate financial and cost performances (CC1) Evaluate the financial and cost performance using QuickBooks. |

Evaluate | PC1 |

| Communication, Information Technology, and Numerical Skills | Level of Learning | Related PLO |

| Create Accounting Entries (CCIT1) Make accounting entries for a service company, and a trading inventory company by using QuickBooks |

Create | PCIT2 |

| Evaluate the effectiveness of QuickBooks (CCIT2) Evaluate the effectiveness of QuickBooks by generating accounting reports. |

Evaluate | PCIT2 |

| Interpersonal Skills and Responsibilities | Level of Learning | Related PLO |

| Work Ethically (CIP1) Work in accordance with the predefined accounting transactions. |

Value | PIP2 |

Grades will be determined based on the following assessments and score allocations:

| SKILL | Assessment | Skill Weighting for Grade |

|||||

|---|---|---|---|---|---|---|---|

| Participation | Assignment (Group) | Assignment (Individual) | In Class Test (2) | Final Exam | |||

| Explain Cloud Computing and Cloud Accounting (CK1) | 100% | 5% | |||||

| Describe the basic steps of recording business transactions (CK2) | 75% | 25% | 20% | ||||

| Evaluate financial and cost performances (CC1) | 50% | 50% | 15% | ||||

| Create Accounting Entries (CCIT1) | 50% | 50% | 30% | ||||

| Evaluate the effectiveness of QuickBooks (CCIT2) | 30% | 30% | 40% | 20% | |||

| Work Ethically (CIP1) | 100% | 10% | |||||

This course is primarily lecture and assignment based; assigned readings will support learning and serve as a reference to material covered in class. During class, approximately half of the class will be devoted to lecture with another half of the class working on case studies and problem sets and reviewing the solutions.

During the course, there are two assignments:

| Assignment 1: | QuickBooks for Service Business |

| Work Group: | Group |

| Output format: | QuickBooks file (in PDF format) |

| Language: | English |

| Description: |

The first assignment requires one student (assignment lead) to set up the QuickBooks accounts for a service business and then add team members (other users – other users will need to sign up as well), record a series of transactions and events and produce relevant financial statements. |

| Assignment 2: | QuickBooks for Trading Business |

| Work Group: | Individual |

| Output format: | QuickBooks file (in PDF format) |

| Language: | English |

| Description: | The second assignment requires each student to set up a QuickBooks account for an inventory trading business, record a series of transactions and events and produce relevant financial statements. |

| Assignment Rubric |

This course has specific targets to be achieved (see the study plan below). The implementation may somewhat vary depending on the progress and needs of students. For example, some topics may be allocated more or less than 1.5 hours.

| Lesson Learning Outcomes | Teaching and Learning Activities, Assessment | |||

|---|---|---|---|---|

| 1 |

Overview of Cloud Computing & Cloud Accounting

|

Lecture Reading: Chapter 1 of Lecture Handouts |

||

| 2 |

Overview of Cloud Computing & Cloud Accounting

|

Lecture Reading: Chapter 1 of Lecture Handouts |

||

| 3 |

Overview of Cloud Computing & Cloud Accounting

|

Lecture Reading: Chapter 1 of Lecture Handouts |

||

| 4 |

Overview of Cloud Computing & Cloud Accounting

|

Lecture Reading: Chapter 1 of Lecture Handouts |

||

| 5 |

Applied QuickBooks Part I Service Company (CK1, CK2, CK3, CCIT1, CCIT3) Case Study 1

|

Lecture Reading: Chapter 2 of Lecture Handouts |

||

| 6 |

Applied QuickBooks Part I Service Company (CK1, CK2, CK3, CCIT1, CCIT3) Case Study 1

|

Lecture Reading: Chapter 2 of Lecture Handouts |

||

| 7 |

Applied QuickBooks Part I Service Company (CK1, CK2, CK3, CCIT1, CCIT3) Case Study 1

|

Lecture Reading: Chapter 2 of Lecture Handouts |

||

| 8 |

Applied QuickBooks Part I Service Company (CK1, CK2, CK3, CCIT1, CCIT3) Case Study 1 1. Explain the recording transactions in QuickBooks (CCIT1): _ Expenditure (payment) |

Lecture Reading: Chapter 2 of Lecture Handouts |

||

| 9 |

Applied QuickBooks Part I Service Company (CK1, CK2, CK3, CCIT1, CCIT3) Case Study 1 1. Explain the recording transactions in QuickBooks (CCIT1): a. Purchase on credit – Click Vendor and Click Enter Bills. |

Lecture Reading: Chapter 2 of Lecture Handouts |

||

| 10 |

Applied QuickBooks Part I Service Company (CK1, CK2, CK3, CCIT1, CCIT3) Case Study 1 2. Demonstrate how to close an accounting book on Profit and Loss Account (or Income Statement). (CK2) d. Cross check the revenues from QuickBooks must be equal to revenue in Excel list. |

Lecture Reading: Chapter 2 of Lecture Handouts |

||

| 11 |

Applied QuickBooks Part I Service Company (CK1, CK2, CK3, CCIT1, CCIT3) Case Study 1 2. Demonstrate how to close an accounting book on Statement of Financial Position (CK2). a. Cross check the cash on hand from QuickBooks must be equal cash on hand in Excel list c. Cross check account receivable from QuickBooks must be an equal account receivable in Excel list. |

Lecture Reading: Chapter 2 of Lecture Handouts |

||

| 12 |

Applied QuickBooks Part I Service Company (CK1, CK2, CK3, CCIT1, CCIT3) Case Study 1 a. Explain the fixed assets and intangible assets and depreciation method. |

Lecture Reading: Chapter 2 of Lecture Handouts |

||

| 13 |

Applied QuickBooks Part I Service Company (CK1, CK2, CK3, CCIT1, CCIT3) Case Study 1 3. Prepare a bank reconciliation (QuickBooks report with bank statement) (CK2, CC1) a. Prepare Statement of profit & loss 5. Export/Import Features |

Lecture Reading: Chapter 2 of Lecture Handouts |

||

| 14 |

Applied QuickBooks Part I Service Company (CK1, CK2, CK3, CCIT1, CCIT3) 1. Review |

Lecture Reading: Chapter 2 of Lecture Handouts |

||

| 15 |

Applied QuickBooks Part I Service Company (CK1, CK2, CK3, CCIT1, CCIT3) Case Study 2 6. Case Study 2 – background & updating Chart of Accounts |

Lecture Reading: Chapter 2 of Lecture Handouts |

||

| 16 |

Applied QuickBooks Part I Service Company (CK1, CK2, CK3, CCIT1, CCIT3) Case Study 2 7. Case Study 2 – recording transactions (Profit and Loss Account (or Income Statement) items) |

Lecture Reading: Chapter 2 of Lecture Handouts |

||

| 17 |

Applied QuickBooks Part I Service Company (CK1, CK2, CK3, CCIT1, CCIT3) 8. Case Study 2 – recording transactions (Statement of Financial Position) items |

Lecture Reading: Chapter 2 of Lecture Handouts |

||

| 18 |

Applied QuickBooks Part I Service Company (CK1, CK2, CK3, CCIT1, CCIT3) Case Study 2 9. Case Study 2 – generating reports and prepare a bank reconciliation |

Lecture Reading: Chapter 2 of Lecture Handouts |

||

| 19 |

Applied QuickBooks Part I Service Company (CK1, CK2, CK3, CCIT1, CCIT3) Case Study 2 – Review of Service Company |

Lecture Reading: |

||

| 20 |

Applied QuickBooks Part II Trading Inventory Company (CK1, CK2, CCIT1, CCIT3) Case Study 3 Explain how to set up Inventory Items (CK1, CK2) 1. Explain How to record sales order (SO) and invoice. (CK2, CCIT1) |

Lecture Reading: Chapter 3 of Lecture Handouts |

||

| 21 |

Applied QuickBooks Part II Trading Inventory Company (CK1, CK2, CCIT1, CCIT3) Case Study 3 5. Describe how to record adjust quantity/Value on hand (CK2, CCIT1) |

Lecture Reading: Chapter 3 of Lecture Handouts |

||

| 22 |

Applied QuickBooks Part II Trading Inventory Company (CK1, CK2, CCIT1, CCIT3) Case Study 3 8. Categorize & Record all entries (CK2, CCIT1) 9. Explain how to calculate the figures needed for the preparation of the financial statement (CK2, CCIT1) |

Lecture Reading: Chapter 3 of Lecture Handouts |

||

| 23 |

Applied QuickBooks Part II Trading Inventory Company (CK1, CK2, CCIT1, CCIT3) Case Study 3 10.Prepare the financial statement for a company and how to close accounting books. (CK2, CC1, CCIT1)

|

Lecture Reading: Chapter 3 of Lecture Handouts |

||

| 24 |

Applied QuickBooks Part II Trading Inventory Company (CK1, CK2, CCIT1, CCIT3) Case Study 3 10. Prepare the financial statement for a company and how to close accounting books. (CK2, CC1, CCIT1)

|

Lecture Reading: Chapter 3 of Lecture Handouts |

||

| 25 |

Applied QuickBooks Part II Trading Inventory Company (CK1, CK2, CCIT1, CCIT3) Case Study 3

|

Lecture Reading: Chapter 3 of Lecture Handouts |

||

| 26 | Create User Stories to articulate requirements (reflections of QuickBooks lessons step-by-step) | Lecture Hands-on Practice |

||

| 27 | Review Quiz 2 |

|||

| 28 |

Apply QuickBooks Part III Trading Inventory Company Case Study 4

|

Lecture Reading: Chapter 4 of Lecture Handouts |

||

| 29 |

Apply QuickBooks Part III Trading Inventory Company Case Study 4 2. Prepare the financial statement for trading inventory company and close accounting books (CK2, CCIT1) |

Lecture Reading: Chapter 4 of Lecture Handouts |

||

| 30 | Review Session, covering Service Company, Inventory Trading Company and Manufacturing Company |

Lecture Reading: Chapter 5 of Lecture Handouts |

||

| Total Hours: 45 hours | ||||

Textbook

References