1. COURSE DESCRIPTION

The course will introduce a broad range of economic subjects including banking, financial intermediation, asset and liability management, financial decision making, financial markets and institutions, and accounting. This wide range of topics gives an in-depth understanding of the way that organizations and financial systems work.

2. REASON FOR THE COURSE

The course teaches the structure and function of financial institutions, the financial markets and institutions such as commercial banks and other financial institutions that play an important role in the development of the economy, and the main regulators of those institutions such as the Federal Reserve Bank, the European Central Bank, and the National Bank of Cambodia (NBC), and other regulators of the financial sectors.

In addition, this course also provides the students with the conceptual framework necessary to analyze and comprehend the current problems confronting managers in banking and other financial institutions. This course should be a step in developing students’ ability to work within the financial sector, in addition to enabling them an increased appreciation on how the economy and the financial sector work.

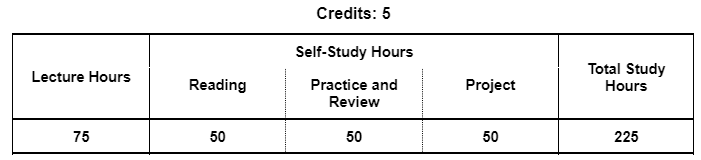

3. STUDY HOURS

4. ROLE IN CURRICULUM

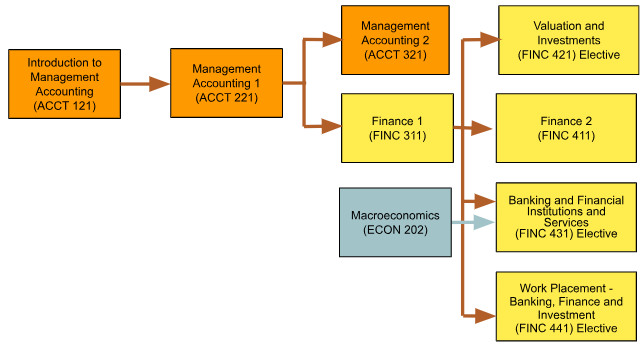

Prerequisites:

Students must have successfully completed at least one of the following two subjects: Macroeconomics (ECON 202) and Finance 1 (FINC 311).

Upon successful completion of this course, students should be able to:

| Knowledge | Level of Learning |

Related PLO |

|---|---|---|

| Describe Financial Institutions (CK1) Describe the different types and importance of the financial institutions, regulations and financial markets with focus on banking and other financial institutions’ risk management. |

Understand | PK1 |

| Cognitive Skills | Level of Learning |

Related PLO |

| Assess Regulatory Impacts (CC1) Assess the importance and possible detriment of the regulatory environment provided by domestic and global governments.. |

Evaluate | PC1 |

| Examine Organizations in Banking and Financial Service Industries (CC2) Examine the different types of organizations used in the banking and financial service industries to manage financial risk. |

Analyze | PC1 |

| Apply Economics and Financial Principles (CC3) Apply the economic and financial principles to better understand the functioning of the financial sectors and the economy. |

Apply | PC4 |

| Communication, Information Technology, and Numerical Skills | Level of Learning |

Related PLO |

| Use Excel/Spreadsheet (CCIT1) Use excel/spreadsheet to conduct basic analysis of data for purposes of forecasting, simulation, scenario analysis and model business. |

Apply | PCIT2 |

| Interpersonal Skills and Responsibilities | Level of Learning |

Related PLO |

| Coordinate Teamwork (CIP1) Coordinate team activity in discussing qualitative and quantitative findings. |

Characterize | PIP1 |

Grades will be determined based on a grading score, calculated using the following assessments and score allocations:

| CLO Topic | CLO Assessment and Scoring | Weighting for Course Grade | |||||

|---|---|---|---|---|---|---|---|

| Participation | In-class test | Project | Midterm Exam | Final Exam | |||

| Describe Financial Institutions (CK1) | 30% | 20% | 50% | 15% | |||

| Assess Regulatory Impacts (CC1) | 30% | 20% | 50% | 20% | |||

| Examine Organizations in Banking and Financial Service Industries (CC2) | 20% | 40% | 40% | 20% | |||

| Apply Economics and Financial Principles (CC3) | 20% | 40% | 40% | 15% | |||

| Use Excel/Spreadsheet (CCIT1) | 20% | 40% | 40% | 15% | |||

| Coordinate Teamwork (CIP1) | 40% | 15% | |||||

This course is primarily lecture-based; assigned readings will support learning and serve as a reference to material covered in class. During class, approximately half of the class will be devoted to lectures with another half of the class working on and reviewing the solutions to case studies and problem sets.

During the course, there is one assignment. The Equity Portfolio Game will be recorded as in-class tests.

| Assignment: |

Financial Market Research (CK1, CC3, CCIT1 & CIP1) |

| Work Group: | Group |

| Final product: | APA Format Report |

| Language: | English |

|

Description: |

The assignment topics are selected from the sections on money markets, bond and equity, and derivative markets that have been recently introduced in Cambodia. In addition, the sections on risk management and how the Cambodian financial markets can be assimilated into the ASEAN and international markets. Assignment Rubric: |

The course targets the 50 lessons in the study plan below. Each lesson is 1.5 class hours each; there are a total of 75 class hours. The study plan below describes the learning outcome for each lesson, described in terms of what the student should be able to do at the end of the lesson. Readings should be done by students as preparation before the start of each class. Implementation of this study plan may vary depending on the progress and needs of students.

| Lesson Learning Outcomes | Teaching and Learning Activities, Assessment | |||

|---|---|---|---|---|

| 1 |

Overview of the Financial Markets and Financial Institutions

|

Lecture Note 1, 2 Reading: Ch1 |

||

| 2 |

Overview of the Financial Markets and Financial Institutions

|

Lecture 1, 2 Reading: Ch1 |

||

| 3 |

Project Assignment Overview

|

Lecture |

||

| 4 |

Central Banks

|

Lecture Note 3 Reading: Ch2,3&4 |

||

| 5 |

Project Assignment 1 (MacroEconomics) (CIP1) |

Team Assignment |

||

| 6 |

Interest Rates & TVM

|

Lecture Note 4 Reading: Ch5, Ch6 |

||

| 7 |

Bank Loans

|

Lecture Note 5 Reading: Ch8 |

||

| 8 |

Bond Markets 1

|

Lecture Note 7, 8 Reading: Ch8 |

||

| 9 |

Bond Market 2

|

Lecture Note 7, 8 |

||

| 10 |

Project Assignment 2 (Bank Loan) (CIP1) |

Team Assignment |

||

| 11 |

Project Assignment 3 (Bond Market) (CIP1) |

Team Assignment |

||

| 12 |

Money Markets

|

Lecture Note 6 Reading: Ch7 |

||

| 13 |

Project Assignment 4 (Money Market) (CIP1) |

Team Assignment |

||

| 14 |

Equity Markets 1

|

Lecture Note 9 Reading: Ch10 |

||

| 15 |

Equity Markets 2

|

Lecture Note 9 |

||

| 16 |

Project Assignment 5 (Equity) (CIP1) |

Team Assignment |

||

| 17 |

Project Assignment 6 (Equity) (CIP1) |

Team Assignment |

||

| 18 |

Derivatives Markets 1

|

Lecture Note 10 Reading: Ch11 |

||

| 19 |

Derivatives Markets 2

|

Lecture Note 10 Reading: Ch11 |

||

| 20 |

Derivatives Markets 3

|

Lecture Note 10 |

||

| 21 |

Project Assignment 7 (Derivatives) (CIP1) |

Team Assignment |

||

| 22 |

Reviews (MidTerm) |

Lecture |

||

| 23 |

Commercial Banks

|

Lecture Note 11 Reading: Ch13,14,15 |

||

| 24 |

Banks in Cambodia

|

Lecture Note 12 Reading: Ch13,14 |

||

| 25 |

Project Assignment 8 (Bank 1) |

Team Assignment |

||

| 26 |

Project Assignment 9 (Bank 2) |

Team Assignment |

||

| 27 |

Fintech in Cambodia

|

Lecture 12 Reading: Ch13, 14,15 |

||

| 28 |

Project Assignment 10 (Fintech 1) (CIP1) |

Team Assignment |

||

| 29 |

Project Assignment 11 (Fintech 2) (CIP1) |

Team Assignment |

||

| 30 |

International Banking

|

Lecture Note 13 Reading: Ch14 |

||

| 31 |

Project Assignment 12 (International Bank) |

Team Assignment |

||

| 32 |

Financial Institutions: Micro-Finance Institutions in Cambodia

|

Lecture Note 12 Reading: Ch13, 15,16 |

||

| 33 |

Project Assignment 13 (MFI) (CIP1) |

Team Assignment |

||

| 34 |

Project Assignment 14 (MFI) (CIP1) |

Team Assignment |

||

| 35 |

Financial Institutions: Insurance Companies and Pension Funds 1

|

Lecture Note 14, 15 Reading: Ch17 |

||

| 36 |

Financial Institutions: Insurance Companies and Pension Funds 2

|

Lecture Note 14, 15 Reading: Ch17 |

||

| 37 |

Project Assignment 15 (Insurance 1) (CIP1) |

Team Assignment |

||

| 38 |

Project Assignment 16 (Insurance 2) (CIP1) |

Team Assignment |

||

| 39 |

Investment Banking

|

Lecture Note 16 Reading: Ch18 |

||

| 40 |

Project Assignment 17 (Underwriter) (CIP1) |

Lecture Note 17 Reading: Ch19 |

||

| 41 |

Investment Companies

|

Lecture Note 17 Reading: Ch19 |

||

| 42 |

Project Assignment 18 (Investment Fund) (CIP1) |

Team Assignment |

||

| 43 |

Asset Management 1

|

Lecture Note 18, 19 |

||

| 44 |

Asset management 2

|

Lecture Note 18, 19 |

||

| 45 |

Asset management 3

|

Team Quizz | ||

| 46 |

Team Presentations – Complete Report (CK2, CC2, CCIT1, CIP1) |

Team presentations and feedback | ||

| 47 |

Risk Management in Financial Institutions

|

Lecture Note 20 Reading: Ch20 |

||

| 48 |

Project Assignment 20 (Risk Management) (CIP1) |

Team Assignment |

||

| 49 |

Reviews |

Lecture |

||

| 50 |

Reviews |

Lecture |

||

| Total Hours 75 hours | ||||

Textbook

References