1. COURSE DESCRIPTION

This course teaches knowledge and skills relating to the tax system as applicable to individuals and companies. The students will use the knowledge gained from the class to identify which taxes should be relevant applied to individuals or companies.

In this course, assessments include a quiz, tax simulation in which students will prepare monthly tax declarations for local companies and final exams.

2. REASON FOR THE COURSE

Accountants and (or) tax consultants must be able to prepare monthly tax returns and tax on income for a company. In Cambodia, Tax laws have been updated from time to time. Therefore, program graduates will be preparing tax returns and solving tax issues following Cambodian tax law and regulation.

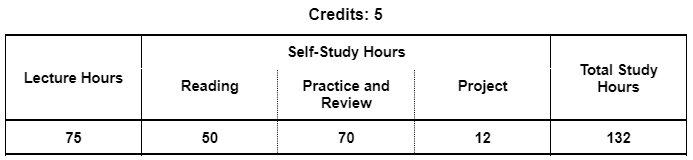

3. STUDY HOURS

4. ROLE IN CURRICULUM

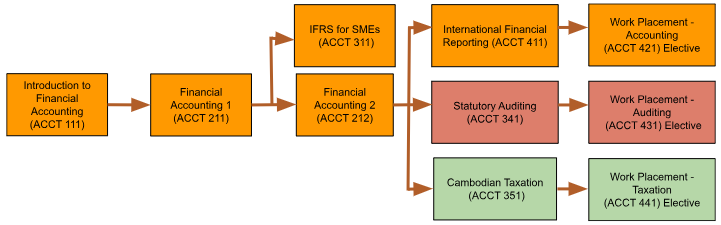

Prerequisites:

Students must have successfully passed Financial Accounting 1 (ACCT 211) and Financial Accounting 2 (ACCT 212) before attempting this course.

On successful completion of this course, students will be able to:

| Knowledge | Level of Learning | Related PLO |

|---|---|---|

| Describe Cambodian Tax System (CK1) Describe the scope and operations of the Cambodian tax system. |

Understand | PK3 |

| Cognitive Skills | Level of Learning | Related PLO |

| Apply Tax Liabilities in Cambodia (CC1) Apply monthly tax returns and tax on income for business in Cambodia in compliance with Cambodian tax law and regulations. |

Apply | PC3 |

| Communication, Information Technology, and Numerical Skills | Level of Learning | Related PLO |

| (None) | ||

| Interpersonal Skills and Responsibilities | Level of Learning | Related PLO |

| Discuss Tax Implications (CCIT1) Discuss with tax officers about Cambodian tax issues. |

Characterize | PICT1 |

Grades will be determined based on the following assessments and score allocations:

| SKILL | Assessment | Skill Weighting for Grade | |||

|---|---|---|---|---|---|

| Quiz | Tax Simulation |

Final Exam |

|||

| Describe Cambodian Tax System (CK1) | 100% | 10% | |||

| Apply Tax Liabilities in Cambodia (CC1) | 20% | 40% | 40% | 70% | |

| Discuss Tax Implications (CCIT1) | 50% | 50% | 20% | ||

This course is primarily lecture, case study, activity and simulation based. Assigned readings will support learning and serve as a reference to materials covered in class. During class, approximately one hour of the total class will be devoted to lecture or case study discussion with another 30 minutes of the class will be for practice and other activities. During the course students will undergo a comprehensive tax simulation.

Tax Simulation 1 : Group (Monthly Tax Declaration)

Tax Simulation 2 : Individual (E-filing, Monthly Tax Declaration)

Tax Simulation 3 : Group (Annual Tax on Income)

Tax Simulation 4 : Individual (Annual Tax on Income)

The course targets the 50 lessons in the study plan below. Each lesson is 1.5 class hours each; there are a total of 75 class hours. The study plan below describes the learning outcome for each lesson, described in terms of what the student should be able to do at the end of the lesson. Readings should be done by students as preparation before the start of each class. Implementation of this study plan may vary somewhat depending on the progress and needs of students.

| Lesson Learning Outcomes | Teaching and Learning Activities, Assessment | |||

|---|---|---|---|---|

| 1 |

Cambodian Tax System

|

Lecture (T) Discussion and question Reading: Law on Taxation (chapter 1) |

||

| 2 |

Cambodian Tax System

|

Lecture (T) Discussion and question Reading: Law on Taxation (chapter 1) |

||

| 3 |

Tax on Salary 1

|

Lecture (T) Discussion and question Reading: Law on Taxation (chapter 2) |

||

| 4 |

Tax on Salary 2

|

Lecture (T) Discussion and question Reading: Law on Taxation (chapter 2) |

||

| 5 |

Tax on Salary 3

|

Lecture (T) Discussion and question Reading: |

||

| 6 |

Tax on Salary 4

|

Lecture (T) Discussion and question Quiz (A) Reading: |

||

| 7 |

Withholding Tax 1

|

Lecture (T) Discussion and question Reading: Law on Taxation (Article 25-27, 33-35, 38-39, and 88) Order (Prakas) Tax on Profit (section 1.3-1.5, 8.2-8.7, 9.3) |

||

| 8 |

Withholding Tax 2

|

Lecture (T) Discussion and question Reading: Law on Taxation (Article 25-27, 33-35, 38-39, and 88) Order (Prakas) Tax on Profit (section 1.3-1.5, 8.2-8.7, 9.3) |

||

| 9 |

Withholding Tax 3

|

Lecture (T) Discussion and question Reading: Law on Taxation (Article 25-27, 33-35, 38-39, and 88) Order (Prakas) Tax on Profit (section 1.3-1.5, 8.2-8.7, 9.3) |

||

| 10 |

Withholding Tax 4

|

Lecture (T) Discussion and question Quiz (A) Reading: Law on Taxation (Article 25-27, 33-35, 38-39, and 88) Order (Prakas) Tax on Profit (section 1.3-1.5, 8.2-8.7, 9.3) |

||

| 11 |

VAT 1

|

Lecture (T) Discussion and question Reading: Law on Taxation, Section 3,Art 55-84 |

||

| 12 |

VAT 2

|

Lecture (T) Discussion and question Reading: Sub-decree on Value Added Tax No.114 ANKR.BK of Royal Government of Cambodia, dated 24 December 1999 |

||

| 13 |

VAT 3

|

Lecture (T) Discussion and question Reading: Sub-decree on Value Added Tax No.114 ANKR.BK of Royal Government of Cambodia, dated 24 December 1999 |

||

| 14 |

VAT 4

|

Lecture (T) Discussion and question Reading: Sub-decree on Value Added Tax No.114 ANKR.BK of Royal Government of Cambodia, dated 24 December 1999 |

||

| 15 |

VAT 5

|

Lecture (T) Discussion and question Reading: Sub-decree on Value Added Tax No.114 ANKR.BK of Royal Government of Cambodia, dated 24 December 1999 |

||

| 16 |

VAT 6

|

Lecture (T) Discussion and question Reading: Order (Prakas) No. 288 dated 31 Mar 2000 on Credit for Using Telephone in Business. Order (Prakas) No.605 dated 01 Sep 2000 Value Added Tax on Electricity Power. |

||

| 17 |

VAT 7

|

Lecture (T) Discussion and question Reading: Order (Prakas) No.312 MEF.PK dated 19 March 2014 on the implementation VAT on import and supply of certain goods |

||

| 18 |

VAT 8

|

Lecture (T) Discussion and question Reading: No.114 ANKR.BK of Royal Government of Cambodia, dated 24 December 1999 Sub-decree on Value Added Tax. Order (Prakas) No.1031 MEF VAT 24 Dec 1998 on Value Added Tax. |

||

| 19 |

VAT 9

|

Lecture (T) Discussion and question Reading: Order (Prakas) No.312 MEF.PK dated 19 March 2014 on the implementation VAT on import and supply of certain goods |

||

| 20 |

VAT 10

|

Lecture (T) Discussion and question Quiz (A) Reading: No.114 ANKR.BK of Royal Government of Cambodia, dated 24 December 1999 Sub-decree on Value Added Tax. |

||

| 21 |

Tax on Income 1

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the tax on profit Order (Prakas) on Tax on Profit, |

||

| 22 |

Tax on Income 2

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the Tax on Profit |

||

| 23 |

Tax on Income 3

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the Tax on Profit |

||

| 24 |

Tax on Income 4

|

LLecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the Tax on Profit |

||

| 25 |

Tax on Income 5

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the Tax on Profit |

||

| 26 |

Tax on Income 6

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the Tax on Profit |

||

| 27 |

Tax on Income 7

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the Tax on Profit |

||

| 28 |

Tax on Income 8

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the Tax on Profit |

||

| 29 |

Tax on Income 9

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the Tax on Profit |

||

| 30 |

Tax on Income 10

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the Tax on Profit |

||

| 31 |

Tax on Income 11

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the Tax on Profit |

||

| 32 |

Tax on Income 12

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the Tax on Profit |

||

| 33 |

Tax on Income 13

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the Tax on Profit |

||

| 34 |

Tax on Income 14

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the Tax on Profit |

||

| 35 |

Tax on Income 15

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the Tax on Profit |

||

| 36 |

Tax on Income 16

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 1, Provision for the Tax on Profit |

||

| 37 |

Prepayment of Profit tax

|

Lecture (T) Discussion and question Quiz (A) Reading: Article 28 (New) of Law on Taxation Order (Prakas) No.305 MEFPTD dated 23 April 2008 on the suspension of prepayment tax on profit for garments and shoes procedures for export |

||

| 38 |

Public lighting tax

|

Lecture (T) Discussion and question Reading: Inter-ministries Order (Prakas) on management and collection of Public Lighting Tax No.583 MEFTDPK dated 30 July 1999 |

||

| 39 |

Specific tax on certain merchandise and services/excise tax

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 4, Art 85 |

||

| 40 |

Accommodation tax

|

Lecture (T) Discussion and question Reading: Order (Prakas) 380 MEFTD dated 14 July 2005 on implementation of Accommodation Tax |

||

| 41 |

Immovable Property tax

|

Lecture (T) Discussion and question Reading: The Financial Act of 2010, Art 13-17 |

||

| 42 |

Obligation of Taxpayers 1

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 5, Provision on tax rules and procedures |

||

| 43 |

Obligation of Taxpayers 2

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 5, Provision on tax rules and procedures |

||

| 44 |

Obligation of Taxpayers 3

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 5, provision on tax rules and procedures |

||

| 45 |

Obligation of Taxpayers 4

|

Lecture (T) Discussion and question Reading: Law on Taxation, Chapter 5, provision on tax rules and procedures |

||

| 46 |

Tax Avoidance, Common Tax Issues, Errors, Disputes and Resolutions (1)

|

Lecture (T) Discussion and question Reading: general discussions |

||

| 47 |

Tax Avoidance, Common Tax Issues, Errors, Disputes and Resolutions (2)

|

Lecture (T) Discussion and question Quiz (A) Reading: general discussions |

||

| 48 | Review and Preparation for Final Exam. (All CLOs) | Lecture Discussion and question |

||

| 49 | Review and Preparation for Final Exam. (All CLOs) | Lecture Discussion and question |

||

| 50 | Review and Preparation for Final Exam. (All CLOs) | Lecture Discussion and question |

||

| Total Hours 75 hours | ||||

Textbook

Examinable Document References