1. COURSE DESCRIPTION

Finance 1 introduces students to different ways of managing finance within an organization with the aim of enhancing business performance. This includes planning and controlling cash flow in both the short and long term, how to manage capital investment decisions and managing trade credit for an efficient flow of cash.

The course starts by introducing the principles of effective working capital management, and the impact working capital has on an organization’s cash flow. It then looks at the techniques for forecasting cash to aid an organization in planning its cash needs.

The next area of the course looks at the different ways of managing cash in the short, medium and long term, including investing funds in capital projects. It finally looks at procedures for effective credit management to maximize flow of cash to the business.

2. REASON FOR THE COURSE

This course aims to develop knowledge and understanding of ways organizations finance their operations, plan and control cash flows, optimize their use of working capital and allocate resources to long term investment projects.

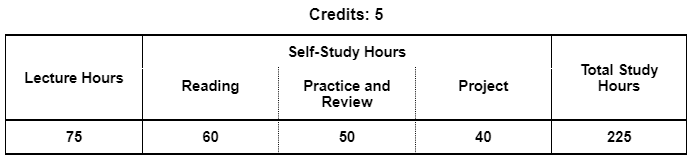

3. STUDY HOURS

4. ROLE IN CURRICULUM

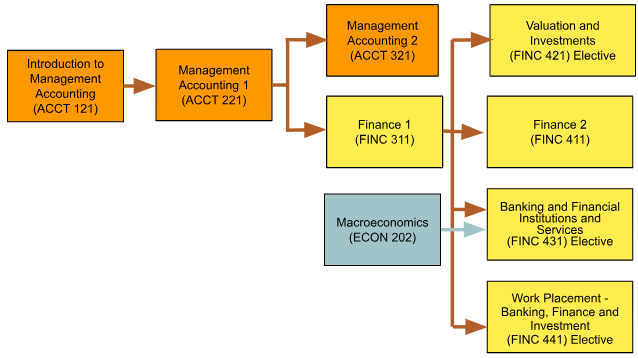

Prerequisites:

Students must have completed Management Accounting 1 before attempting this course.

On successful completion of this course, students will be able to:

| Knowledge | Level of Learning | Related PLO |

|---|---|---|

| Explain the principles of Finance (CK1) Explain the principles of working capital management in making capital investment decisions. |

Understand | PK1 |

| Discuss methods and procedures of Finance (CK2) Discuss methods and procedures for managing cash balance. |

Understand | PK1 |

| Cognitive Skills | Level of Learning | Related PLO |

| Appraise General Business Problems (CC1) Appraise general business problems to identify assumptions and decision making constraints. |

Evaluate | PC1 |

| Administer Techniques to Forecast Cash Flow (CC2) Administer a range of techniques to forecast cash flow and solve quantitative problems with or without use of spreadsheets. |

Apply | PC4 |

| Communication, Information Technology, and Numerical Skills | Level of Learning | Related PLO |

| Use Excel/Spreadsheet (CCIT1) Use Excel/Spreadsheet to conduct basic analysis of data for purposes of forecasting, simulation and scenario analysis and to model business. |

Apply | PCIT2 |

| Interpersonal Skills and Responsibilities | Level of Learning | Related PLO |

| Arrange Teamwork (CIP1) Arrange teamwork to do forecast presentation, spreadsheets and output thereof in a clear and professional format. |

Organize | PIP1 |

Grades will be determined based on a grading score, calculated using the following assessments and score allocations:

| SKILL | CLO Assessment and Scoring | Skill Weighting for Grade | ||||

|---|---|---|---|---|---|---|

| Participation | Assignment | Midterm Exam | Final Exam | |||

| Explain the principles of Finance (CK1) | 30% | 40% | 30% | 10% | ||

| Discuss methods and procedures of Finance (CK2) | 30% | 40% | 30% | 15% | ||

| Appraise General Business Problems (CC1) | 30% | 30% | 20% | 20% | 20% | |

| Administer Techniques to Forecast Cash Flow (CC2) | 30% | 30% | 20% | 20% | 20% | |

| Use Excel/Spreadsheet (CCIT1) | 20% | 40% | 20% | 20% | 20% | |

| Arrange Teamwork (CIP1) | 20% | 80% | 15% | |||

This course is primarily lecture and assignment based; assigned readings will support learning and serve as a reference to material covered in class. During class, approximately half of the class will be devoted to lecture with another half of the class for working on case studies and problem sets and reviewing the solutions.

During the course, there is one assignment:

| Assignment: | Financial Business Plan (CK1, CK2, CC1, CC2, CCIT1 & CIP1) |

| Work Group: | Group |

| Output format: | Professional Format, Presentation |

| Language: | English |

| Description: |

In groups of 3-5, students are required to prepare a business plan, including the following:

|

| Assignment Rubric: |

The course targets the study plan below. Implementation may vary somewhat depending on the progress and needs of students. For example, some topics may be allocated more or less than 1.5 hours.

| Lesson Learning Outcomes | Teaching and Learning Activities, Assessment | |

|---|---|---|

| 1 |

Introduction, Working Capital

|

Lecture Calculate over-trading and over-capitalization financial indicatorsPractice Reading: Chapter 1 |

| 2 |

Introduction, Working Capital (continued) 4. Demonstrate the calculation of the working capital cycle. (CK2) 5. Outline the possible relationships between inventory levels and sales. (CK2) 6. Define and explain over-trading and over-capitalisation. (CK2) |

Lecture PracticeReading: Chapter 1 |

| 3 | Exercises & Review (CK1, CC1, CCIT1) | Practice Quiz |

| 4 |

Inventory Management and Control 1. Discuss the key considerations. (CK1) 2. Define and explain work-in-progress. (CK1) 3. Define economic order quantity. (CK1) |

Lecture PracticeReading: Chapter 2 |

| 5 |

Inventory Management and Control (continued) 4. Apply the EOQ model (CK1) |

Lecture Practice Discuss the effects of just-in-time on inventory controlReading: Chapter 2 |

| 6 | Exercises & Review (CK1, CC1, CCIT1) | Practice Quiz |

| 7 |

Management of Accounts Payable, Cash and Cash Flows

|

Lecture PracticeReading: Chapter 3, 4 |

| 8 |

Management of Accounts Payable, Cash and Cash Flows (continued) 4. Describe the various type and form of accounts payables (CK1) 5. Describe the various accounts payable payment method and procedures (CK1) 6. Evaluate and demonstrate the issues involved with early payment and settlement discounts (CK1) 7. Identify the risks of taking increased credit and buying under extended credit terms (CK1) |

Lecture Identify the risks of taking increased credit and buying under extended credit terms PracticeReading: Chapter 3, 4 |

| 9 | Exercises & Review (CK1, CC1, CCIT1) | Practice / Quiz |

| 10 |

Cash Budgeting and Forecasting 1. Define cash, cash flow and funds (CK2, CC2) 2. Explain the importance of cash flow management and its impact on liquidity and company surviva (CK2, CC2) 3. Outline the various sources and application of finance (CK2) 4. Distinguish between the cash flow patterns of different types of organisations(CK2, CC2) |

Lecture PracticeReading: Chapter 5 |

| 11 |

Cash Budgeting and Forecasting (continued) 5. Explain the importance of cash flow for sustainable growth of such organisations (CK2, CC2) 6. Define cash accounting` and `accrual accounting` (CK2) 7. Reconcile cash flow to profit (CK2, CC2) |

Lecture Discuss the difference between cash accounting and accruals accounting PracticeReading: Chapter 5 |

| 12 | Exercises & Review (CK1, CK2, CC1, CCIT1) | Practice Quiz |

| 13 |

Cash Forecasting Techniques

|

Lecture PracticeReading: Chapter 6 |

| 14 |

Cash Forecasting Techniques (continued) 3. Explain cleared funds forecasts (CK2) |

Lecture PracticeReading: Chapter 6 |

| 15 | Exercises & Review | Practice Quiz |

| 16 |

Treasury Function and Managing Surplus Cash 1. Outline the main treasury functions (CK2) 2. Discuss the advantages and disadvantages of a centralised treasury function (CK2) |

Lecture PracticeReading: Chapter 7 |

| 17 |

Treasury Function and Managing Surplus Cash (continued) 3. Describe cash handling procedure (CK2) 4. Describe the issues to be considered when attempting to hold optimal cash balances. (CK2) 5. Outline the statutory and the other regulations relating to the management of cash. (CK2) |

Lecture Discuss the advantages and disadvantages of centralised cash control PracticeReading: Chapter 7 |

| 18 |

Treasury Function and Managing Surplus Cash (continued) 6. Outline how the Baumol cash management model works (CK2) 7. Discuss the limitations of Baumol cash management model. (CK2) 8. Suggest the appropriate liquidity levels for a range of different organisations (CK2) |

Lecture Practice Reading: Chapter 7 |

| 19 | Exercises & Review (CK1, CK2, CC1, CCIT1) | Practice Quiz |

| 20 |

Overview of Financial Markets (1)

|

Lecture PracticeReading: Chapters 7, 10 |

| 21 |

Overview of Financial Markets (1) (continued) 4. Outline the relationships between financialinstitutions.(CK3) 5. Explain the basic nature of a money market.(CK3) 6. Describe the way in which a stock market.(CK3) 7. Discuss ways in which a company may obtain a stock market listing and the advantages and disadvantages of having a stock market listing. (CK3) |

Lecture Outline the key benefits of financial intermediations PracticeReading: Chapter 8 |

| 22 | Exercises & Review (CK2, CK3, CC1, CCIT1) | Reading: Chapter 8 |

| 23 |

Overview of Financial Markets (2) 1. Explain the purpose and main features of Bank deposits, Certificate of deposit, Government stocks, Local authority bonds, Bills of exchange.(CK3) |

Lecture PracticeReading: Chapter 9 |

| 24 |

Overview of Financial Markets (2) (continued) 2. Explain the purpose and main features of Equity, Preference shares, Secured loan note, Unsecured loan stock, Convertible and redeemable debt, Warrants.(CK3) |

Lecture PracticeReading: Chapter 9 |

| 25 | Exercises & Review (CK3, CC1, CCIT1) | Practice Quiz |

| 26 |

Money in the Economy

|

Lecture PracticeReading: Chapter 11 |

| 27 |

Money in the Economy (continued)

|

Lecture PracticeReading: Chapter 11 |

| 28 | Exercises & Review (CK3, CC1, CCIT1) | Practice Quiz |

| 29 |

Short-term Finance, Long-term Finance, Finance of SMEs

|

Lecture Compare and contrast the main feature of hire purchase and leases PracticeReading: Chapters 12, 13, 14 |

| 30 |

Short-term Finance, Long-term Finance, Finance of SMEs (continued) 5. Evaluate the risks associated with increasing the amount of short-term finance in organisation. (CK3) 6. Discuss the relative merits and limitations of short-term finance.(CK3) 7. Discuss situations where it may be appropriate to raise medium-term finance (CK3) 8. Describe the main features of of hire purchase, and lease (CK3) |

Lecture Discuss situations where it may be appropriate to raise long-term finance PracticeReading: Chapters 12, 13, 14 |

| 31 | Exercises & Review (CK3, CC1, CCIT1) | Practice / Quiz |

| 32 |

Short-term Finance, Long-term Finance, Finance of SMEs (continued) 9. Describe the key factors that should be considered in deciding the mix short/medium/long term finance in an organisation.(CK3) 10. Calculate relative gearing and earning per share under different financial structure(CK3) 11. Outline the requirements for finance of SMEs.(CK3) 12. Describe and discuss the response of government agencies and financial institutions to the SME financing problem.(CK3) |

Lecture Discuss the nature and importance of internally generated funds PracticeReading: Chapters 12, 13, 14 |

| 33 | Exercises & Review (CK3, CC1, CCIT1) | Practice Quiz |

| 34 |

Relevant Costs, Capital Expenditure Budgeting, Investment Appraisal 1. Explain the differences between simple and compound interest.(CK3) 2. Calculate future values (CK3) 3. Discuss the concept of the time value of money and concept of discounting. (CK3) 4. Calculate present values, making use of present value tables to establish discount factors. (CK3) |

Lecture PracticeReading: Chapters 15, 16, 17 |

| 35 |

Relevant Costs, Capital Expenditure Budgeting, Investment Appraisal (continued) 5. Discuss the concept of relevant cash flows for decision-making. (CK4) 6. Identity and evaluate relevant cash flows for individual investment decisions (CK4) 7. Discuss the importance of capital investment planning and control.(CK4) 8. Outline the issues to consider and the steps involved in the preparation of capital expenditure budget (CK4) |

Lecture PracticeReading: Chapters 15, 16, 17 |

| 36 | Exercises & Review (CK4, CC1, CCIT1) | Practice Quiz |

| 37 |

Relevant Costs, Capital Expenditure Budgeting, Investment Appraisal (continued) 9. Define and distinguish between capital and revenue expenditure. (CK4) 10. Compare and contrast investment in non-current assets and investment in working capital. (CK4) 11. Describe capital investment procedures.(CK4) |

Lecture PracticeReading: Chapters 15, 16, 17 |

| 38 |

Relevant Costs, Capital Expenditure Budgeting, Investment Appraisal (continued) 12. Calculate the payback and discounted payback of a project and assess its usefulness as a method of investment appraisal. (CK4) 13. Calculate the accounting rate of return of a project and assess its usefulness as a method of investment appraisal (CK4) 14. Explain the concept of net present value and how it can be used for project appraisal.(CK4) 15. Calculate net present value and interpret the results. (CK4) |

Lecture PracticeReading: Chapters 15, 16, 17 |

| 39 |

Relevant Costs, Capital Expenditure Budgeting, Investment Appraisal (continued) 16. Outline the concept of internal rate of return and how it can be used for project appraisal.(CK4) 17. Calculate internal rate of return and interpret the results.(CK4) 18. Discuss the relative merits of NPV and IRR, including mutually exclusive projects and multiple yields.(CK4) 19. Explain the superiority of DCF methods over payback and accounting rate of return.(CK4) |

Lecture PracticeReading: Chapters 15, 16, 17 |

| 40 | Exercises & Review (CK4, CC1, CCIT1) | Practice Quiz |

| 41 |

Managing Receivables, Assessing and Granting Credit

|

Lecture PracticeReading: Chapters 18, 19 |

| 42 |

Managing Receivables, Assessing and Granting Credit (continued) 5. Explain the need to establish a credit policy and outline the steps involved, including setting maximum credit amounts and period and total credit levels.(CK4) 6. Describe ways in which credit customers could be encouraged ,to pay promptly including effects of offering discounts.(CK4) 7. Identity the main data protection issues that should be considered when dealing with accounts receivable records.Credit scoring. (CK4) |

Lecture Explain the key categories that should be considered when assessing the creditworthiness of a customer PracticeReading: Chapters 18, 19 |

| 43 |

Managing Receivables, Assessing and Granting Credit (continued)

|

Lecture Define and explain credit scoring PracticeReading: Chapters 18, 19 |

| 44 | Exercises & Review (CK4, CC1, CCIT1) | Practice Quiz |

| 45 |

Assessing and Granting Credit, Monitoring and Collecting Debts

|

Lecture Evaluate the usefulness and limitations of ratio analysis in assessing credit-worthiness PracticeReading: Chapters 19, 20 |

| 46 |

Assessing and Granting Credit, Monitoring and Collecting Debts (continued)

|

Lecture Monitor accounts receivable (include credit rating agencies, industry sources, financial reports, press coverage, official publications, bank or supplier reference) PracticeReading: Chapters 19, 20 |

| 47 | Exercises & Review (CK1, CK2, CK4, CC1, CCIT1) | Practice Quiz |

| 48 | Exam review 1 (All s) | Review practice test questions |

| 49 | Exam review 2 (All s) | Review practice test questions |

| 50 | Exam review 3 (All s) | Review practice test questions |

Textbooks

References