1. COURSE DESCRIPTION

This course teaches accounting and financial reporting for individual medium sized businesses of the sort that would use IFRS for SMEs, complementing the IFRS courses that teach accounting for larger businesses. In this course, assessments include controlled case studies and a project in which students will prepare an IFRS for SMEs compliant financial report for a local company.

2. REASON FOR THE COURSE

Accountants must be able to prepare a set of financial statements for a company. In Cambodia, national regulations require companies to follow either CIFRS or CIFRS for SMEs, which are the same as IFRS and IFRS for SMEs. Therefore, program graduates will be preparing, auditing, or using financial statements prepared in accordance with these two standards.

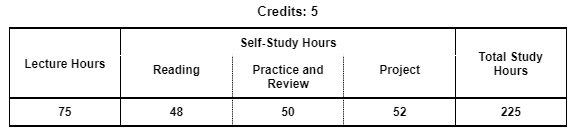

3. STUDY HOURS

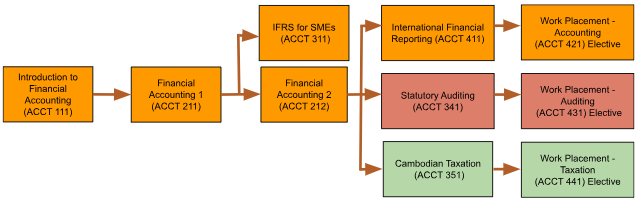

4. ROLE IN CURRICULUM

Prerequisites:

Students must have successfully passed Financial Accounting I (ACCT 211) before attempting this course.

On successful completion of this course, students will be able to:

| Knowledge | Level of Learning |

Related PLO |

|---|---|---|

| Describe IFRS for SMEs (CK1) Describe the objective, applicability and publication of IFRS for SMEs. |

Understand | PC5 |

| Cognitive Skills | Level of Learning |

Related PLO |

| Apply IFRS for SMEs (CC1) Apply IFRS for SMEs to transactions and recognition and measurement assets and liabilities common to SMEs in Cambodia. |

Apply | PC5 |

| Prepare a Financial Report (CC2) Prepare a general purpose financial report for an individual business in Cambodia in compliance with IFRS for SMEs. |

Create | PC5 |

| Communication, Information Technology, and Numerical Skills | Level of Learning |

Related PLO |

|

Prepare a Loan Schedule (CCIT1) |

Apply | PCIT1 |

| Interpersonal Skills and Responsibilities | Level of Learning |

Related PLO |

| Work Ethically (CIP1) Resolve threats to the ACCA Code of Ethics and Conduct. |

Characterize | PIP2 |

Grades will be determined based on the following assessments and score allocations:

| SKILL | Assessment | Skill Weighting for Grade | ||||

|---|---|---|---|---|---|---|

| Participation | Project | Controlled Case Studies | Final Controlled Case Study | |||

| Describe IFRS for SMEs (CK1) | 100% | 5% | ||||

| Apply IFRS for SMEs (CC1) | 40% | 60% | 50% | |||

| Prepare a Financial Report (CC2) | 75% | 25% | 30% | |||

| Prepare a Loan Schedule (CCIT1) | 100% | 5% | ||||

| Work Ethically (CIP1) | 100% | 10% | ||||

This course uses demonstration, lecture, case studies, and group problem solving. Approximately 1/2 of the class time will be demonstrations, presentations and questioning (often using Kahoot!) from the lecturer, with the other 1/2 of the class for working on case studies and problem sets. Case studies and problem sets are delivered via Google Classroom Quiz and Google Sheets.

During the course, there is one Project:

IFRS for SMEs Financial Reporting Project

| Work Group: | Groups of two |

| Output format: | IFRS for SMEs format Financial Report |

| Language: | English and Khmer |

| Assignment: | Students prepare a set of financial statements in compliance with IFRS for SMEs (to the extent possible given constraints and available data) for a small or medium sized business or not-for-profit organization in Cambodia. The financial report will cover a period of two years. Drafts and a final report will be first written in English followed by a Khmer translation. Scoring will be according to the Assignment Rubric. |

The course targets the 50 lessons in the study plan below. Each lesson is 1.5 class hours each; there are a total of 75 class hours. The study plan below describes the skills to be learned in each lesson (learning outcome). Readings should be completed before the start of each class. Implementation of this study plan may vary depending on the progress and needs of students. References are supporting documents which students may optionally read for deeper understanding or clarification.

| Lesson Learning Outcomes | Teaching (T), and Assessment (A) Methods | |

|---|---|---|

| 1 |

Small and Medium-Sized Entities

|

Lecture (T) Reading: IFRS for SMEs, Preface pp 6-9, Section 1 pp 10-11, Section 3 pp 22-26 |

| 2 |

Statement of Financial Position

|

Lecture (T) Reading: IFRS for SMEs, Section 4 pp 27-30; Reference: Module 4 |

| 3 |

Statement of Comprehensive Income

|

Lecture (T) Reading: IFRS for SMEs, Section 2 pp 12-13, 18, Section 8 pp 41-42, Section 10 page 50; Reference: Module 8 |

| 4 |

Concepts, Pervasive Principles, Notes

|

Lecture (T) Reading: IFRS for SMEs, Section 2 pp 12-13, 18, Section 8 pp 41-42, Section 10 page 50; Reference: Module 8 |

| 5 |

ACCA Code of Ethics and Conduct

|

Lecture (T) Reading: ACCA Code of Ethics and Conduct, pp 18-23; Reference: ACCA Code of Ethics and Conduct pp 24-31 |

| 6 |

Accounting Policies, Estimates and Errors

|

Lecture (T) Reading: IFRS for SMEs, Section 10 pp 50-54; Reference: Module 10 |

| 7 |

Basic Financial Instruments

|

Lecture (T) Reading: IFRS for SMEs, Section 11 pp 55-59; Reference: Module 11 |

| 8 |

Basic Financial Instruments – Bad Debts

|

Lecture (T) Reading: IFRS for SMEs, Section 11 pp 62-65; Reference: Module 11 |

| 9 |

Accounting for Loans Payable

|

Demonstration (T) Reading: IFRS for SMEs, Section 11 pp 60-62; Reference: Module 11 |

| 10 |

Controlled Case Study 1

|

Controlled case study (A) |

| 11 |

Accounting for Loans Payable – Effective Interest Rate

|

Demonstration (T) Reading: IFRS for SMEs, Section 11, pp 60-62, 68-70; Reference: Module 11 |

| 12 |

Business and Industry Analysis – Porter’s Five Forces

|

Lecture (T) Reading: Harvard Business Review, pp 25-39 |

| 13 |

Inventories – Part 1

|

Lecture (T) Reading: IFRS for SMEs, Section 13 pp 79-81; Reference: Module 13 |

| 14 |

Inventories – Part 2

|

Demonstration (T) Reading: IFRS for SMEs, Section 13 pp 82-83; Reference: Module 13 |

| 15 |

Student Presentation – Porter’s Five Forces

|

Discussion (T, A) Reading: Harvard Business Review, pp 25-39 |

| 16 |

Investment Property

|

Lecture (T) Reading: IFRS for SMEs, Section 16 pp 92-94 ; References: Module 16 |

| 17 |

Property, Plant and Equipment – Part 1

|

Demonstration (T) Reading: IFRS for SMEs, Section 17 pp 95-101; Reference: Module 17 |

| 18 |

Property, Plant and Equipment – Part 2

|

Demonstration (T) Reading: IFRS for SMEs, Section 17 pp 95-101; Reference: Module 17 |

| 19 |

Property, Plant and Equipment – Part 3

|

Demonstration (T) Group problem (T, A) |

| 20 |

Intangible Assets other than Goodwill

|

Lecture (T) Reading: IFRS for SMEs, Section 18 pp 102-106; Reference: Module 18 |

| 21 |

Impairment of Assets – Part 1

|

Group problems (T, A) Reading: IFRS for SMEs, Section 27 pp 163-170; Reference: Module 27 |

| 22 |

Impairment of Assets – Part 2

|

Case study (T, A) Reading: IFRS for SMEs, Section 27 pp 163-170; Reference: Module 27 |

| 23 |

Controlled Case Study 2

|

Controlled case study (A) |

| 24 |

Leases – Part 1

|

Lecture (T) Reading: IFRS for SMEs,Section 20 pp 113-120; Reference: Module 20 |

| 25 |

Leases – Part 2

|

Lecture (T) Reading: IFRS for SMEs,Section 20 pp 113-120; Reference: Module 20 |

| 26 |

Revenue – Part 1

|

Lecture (T) Reading: IFRS for SMEs Section 23 |

| 27 |

Controlled Csea Study 3

|

Controlled case study (A) |

| 28 |

Revenue – Part 2

|

Lecture (T) Reading: IFRS for SMEs Section 23 |

| 29 |

Revenue – Part 3

|

Lecture (T) Reading: IFRS for SMEs Section 23 |

| 30 |

Employee Benefits – Part 1

|

Lecture (T) Reading: IFRS for SMEs, Section 28 pp 171-172; Reference: Module 28 |

| 31 |

Employee Benefits – Part 2

|

Lecture (T) Reading: IFRS for SMEs, Section 28 pp 171-172; Reference: Module 28 |

| 32 |

Employee Benefits – Part 3

|

Lecture (T) Reading: IFRS for SMEs, Section 28 pp 171-172; Reference: Module 28 |

| 33 |

Income Tax – Part 1

|

Lecture (T) Reading: IFRS for SMEs, Section 29 pp 182, 189; Reference: Module 29 |

| 34 |

Income Tax – Part 2

|

Lecture (T) Reading: IFRS for SMEs, Section 29 pp 182, 189; Reference: Module 29 |

| 35 |

Income Tax – Part 3

|

Demonstration (T) Reading: IFRS for SMEs, Section 29 pp 183-186, 188-189; Reference: Module 29 |

| 36 |

Income Tax – Part 4

|

Demonstration (T) Reading: IFRS for SMEs, Section 29 pp 189-191; Reference: Module 29 |

| 37 |

Cash Flow Statements – Part 1

|

Lecture (T) Reading: IFRS for SMEs, Section 7 pp 36-40; Reference: Module 7 |

| 38 |

Cash Flow Statements – Part 2

|

Demonstration (T) Reading: IFRS for SMEs, Section 7 pp 36-40; Reference: Module 7 |

| 39 |

Cash Flow Statements – Part 3

|

Case study (T, A) Reading: IFRS for SMEs, Section 7 pp 36-40; Reference: Module 7 |

| 40 |

Cash Flow Statements – Part 4

|

Case study (T, A) Reading: IFRS for SMEs, Section 7 pp 36-40; Reference: Module 7 |

| 41 |

Foreign Currency Translation – Part 1

|

Demonstration (T) Reading: IFRS for SMEs, Section 30 pp 192-194; Reference: Module 30 |

| 42 |

Foreign Currency Translation – Part 2

|

Lecture (T) Reading: IFRS for SMEs, Section 30 pp 195-197; Reference: Module 30 |

| 43 |

Related Party Disclosures

|

Lecture (T) Reading: IFRS for SMEs, Section 33 pp 204-207; Reference: Module 33 |

| 44 |

Controlled Case Study 4

|

Controlled case study |

| 45 |

Transition to the IFRS for SMEs

|

Case study (T, A) Reading: IFRS for SMEs, Section 35 pp 213-218; Reference: Module 35 |

| 46 | Review and preparation for final exam – Part 1 | Lecture (T) |

| 47 | Review and preparation for final exam – Part 2 | Lecture (T) |

| 48 | Review and preparation for final exam – Part 3 | Lecture (T) |

| 49 | Student Presentations | Presentation (A) |

| 50 | Student Presentations | Presentation (A) |

Textbooks

References