1. COURSE DESCRIPTION

This course teaches basic costing principles, techniques, and tools to support management in planning, controlling, and decision-making. It also introduces spreadsheets as an essential tool in supporting cost and management accounting. In this course, assessments include a role play in which students will play a role as a trainee accountant in the simulated business environment to support management in making an informed decision on the projects using a new job costing system.

2. REASON FOR THE COURSE

Accountants must be able to collect, classify, and analyze the cost information to support management in planning, controlling, and decision-making. Therefore, program graduates will play an essential role in organizations to provide management with information to make informed decisions in order to improve the business’s profitability.

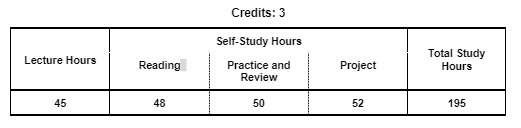

3. STUDY HOURS

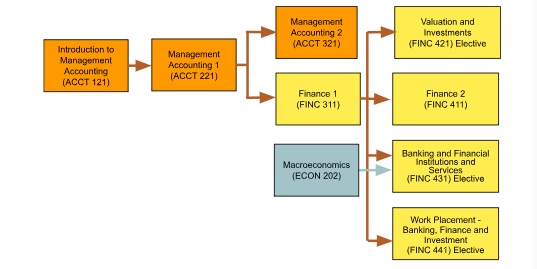

4. ROLE IN CURRICULUM

Prerequisites:

There is no prerequisite for this course.

On successful completion of this course, students will be able to:

| Knowledge | Level of Learning |

Related PLO |

|---|---|---|

| Explain the management accounting (CK1) Explain the nature and purpose of management accounting |

Understand | PC4 |

| Cognitive Skills | Level of Learning |

Related PLO |

| Classify costs (CC1) Classify costs by nature, behavior, and purpose |

Apply | PC4 |

| Account for material, labor, and expenses (CC2) Record costs for material, labor, and expenses |

Create | PC4 |

| Communication, Information Technology, and Numerical Skills | Level of Learning |

Related PLO |

| Calculate the unit costs (CCIT1) Calculate the unit costs of a product or service of a simulated business using the spreadsheets |

Apply | PCIT1 |

| Interpersonal Skills and Responsibilities | Level of Learning |

Related PLO |

| Work in a team (CIP1) Work in a team to suggest a new job costing system to improve the business’s profitability |

Characterize | PIP1 |

Grades will be determined based on the following assessments and score allocations:

| SKILL | Assessment | Skill Weighting for Grade | ||||

|---|---|---|---|---|---|---|

| Participation | Project | Controlled Case Studies | Final Controlled Case Study | |||

| Explain the management accounting (CK1) | 100% | 10% | ||||

| Classify costs (CC1) | 70% | 30% | 20% | |||

| Account for material, labor, and expenses (CC2) | 50% | 50% | 20% | |||

| Calculate the unit costs (CCIT1) | 100% | 40% | ||||

| Work in a team (CIP1) | 100% | 10% | ||||

This course uses demonstration, lecture, case studies, and group problem-solving. Approximately 1/2 of the class time will be demonstrations, presentations, and questioning (often using Kahoot!) from the lecturer, with the other 1/2 of the class working on case studies and problem sets. Case studies and problem sets are delivered via Google Classroom Quiz and Google Sheets.

During the course, there is one Project:

| Assignment: |

The Job Costing Decision |

| Work Group: |

Groups of five |

| Output Format |

Spreadsheet |

| Language: | English |

| Description: |

Students play the role of a trainee accountant undertaking an assignment for business managers to suggest a new job costing system in order to improve the business’s profitability and ensure a return on investment. Scoring will be according to the Assignment Rubric. |

The course targets the 30 lessons in the study plan below. Each lesson is 1.5 class hours; there are a total of 45 class hours. The study plan below describes the skills to be learned in each lesson (learning outcome). Readings should be completed before the start of each class. Implementation of this study plan may vary depending on the progress and needs of students. References are supporting documents that students may optionally read for deeper understanding or clarification.

| Lesson Learning Outcomes | Teaching (T), and Assessment (A) Methods |

|

|---|---|---|

| 1 |

Introduction to Management Accounting Class

|

Discussion Reading: Course Specification |

| 2 |

Business Organisation & Accounting

|

Lecture Reading: Chapter 1 |

| 3 |

Business Organisation & Accounting

|

Lecture Reading: Chapter 1 |

| 4 |

Introduction to Management Information

|

Lecture Reading: Chapter 2 |

| 5 |

Introduction to Management Information

|

Lecture Reading: Chapter 2 |

| 6 |

Cost units, cost classification, and profit reporting

|

Lecture Reading: Chapter 3 |

| 7 |

Cost units, cost classification, and profit reporting

|

Lecture Reading: Chapter 3 |

| 8 |

Cost units, cost classification, and profit reporting

|

Lecture Reading: Chapter 3 |

| 9 |

Management Responsibility & Performance Measurement

|

Lecture Reading: Chapter 4 |

| 10 |

Management Responsibility & Performance Measurement

|

Lecture Reading: Chapter 4 |

| 11 |

Source Documents & Coding System

|

Lecture Reading: Chapter 5 |

| 12 |

Source Documents & Coding System

|

Lecture Reading: Chapter 5 |

| 13 |

Accounting for Materials

|

Lecture Reading: Chapter 6 |

| 14 |

Accounting for Materials

|

ecture Reading: Chapter 6 |

| 15 |

Accounting for Labour

|

Lecture Reading: Chapter 6 |

| 16 |

Accounting for Labour

|

Lecture Reading: Chapter 6 |

| 17 |

Accounting for Labour

|

Lecture Reading: Chapter 6 |

| 18 |

Overhead costs

|

Lecture Reading: Chapter 7 |

| 19 |

Overhead costs

|

Lecture Reading: Chapter 7 |

| 20 |

Overhead costs

|

Lecture Reading: Chapter 7 |

| 21 |

Job, Batch and Process Costing

|

Lecture Reading: Chapter 8 |

| 22 |

Job, Batch, and Process Costing

|

Lecture Reading: Chapter 8 |

| 23 |

Job, Batch, and Process Costing

|

Lecture Controlled Case Study Reading: Chapter 8 |

| 24 |

The Basics of Using Spreadsheets

|

Lecture Reading: Chapter 9 |

| 25 |

The Basics of Using Spreadsheets

|

Lecture Reading: Chapter 9 |

| 26 |

Using Spreadsheets to Present Information

|

Lecture Reading: Chapter 10 |

| 27 |

Using Spreadsheets to Present Information

|

Lecture Reading: Chapter 10 |

| 28 | Exam Questions Review | All Chapters |

| 29 | Exam Questions Review | All Chapters |

| 30 | Exam Questions Review | All Chapters |

Textbooks

References