1. COURSE DESCRIPTION

Management Accounting 1 introduces candidates to costing and financing principles and techniques, and elements of management accounting which are used to make and support decisions. The course starts by introducing candidates to management information clearly distinguishing it from financial accounting information. The next section introduces the basics of recording costs in management accounting. This is followed by coverage of a variety of costing techniques used in business. The next area of the course introduces candidates to the use of management accounting in support of decision making. Finally the course introduces the concept of cash management as an essential element for planning.

This course deals with the principles and techniques used in recording, analyzing and reporting costs and revenues for internal management purposes.

The broad topic areas to be covered are divided into five parts:

PART 1 Management Information

PART 2 Cost Recording

PART 3 Costing Techniques

PART 4 Decision Making

PART 5 Cash Management

2. REASON FOR THE COURSE

The aim of the course is to develop knowledge and understanding of how to prepare, process and present basic cost information to support management in planning and decision-making in a variety of business contexts.

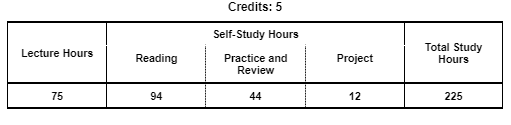

3. STUDY HOURS

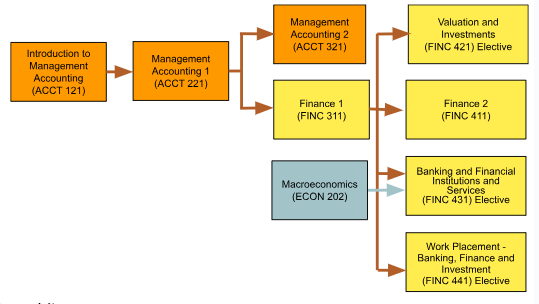

4. ROLE IN CURRICULUM

Prerequisites:

There are no prerequisites for this course, however, students are encouraged to study in the sequence shown above.

On successful completion of this course, students will be able to:

| Knowledge | Level of Learning | Related PLO |

|---|---|---|

| Describe Management Information (CK1) Describe the role of management information and the use of information technology within the organization. |

Understand | PCIT2 |

| Identify Investment and Financing Opportunities (CK2) Identify investment opportunities and different ways of raising finance from the bank. |

Understand | PC5 |

| Cognitive Skills | Level of Learning | Related PLO |

| Prepare Cost Information (CC1) Prepare basic cost information by applying different cost accounting techniques. |

Apply | PC4 |

| Apply Principles of Cash Management and Budgeting (CC2) Apply the principles of cash management and prepare cash budgets/ cash flow forecasts. |

Apply | PC4 |

| Communication, Information Technology, and Numerical Skills | Level of Learning | Related PLO |

| Determine the Cost of Materials (CCIT1) Determine the cost of materials, labour and other expenses. |

Apply | PC3 |

| Apply Management Accounting Techniques in Decision-making (CCIT2) Solve make/buy-in problems and investment decisions using payback (discounted and undiscounted), net present value (NPV), and internal rate of return (IRR). |

Apply | PC4 |

| Interpersonal Skills and Responsibilities | Level of Learning | Related PLO |

| Work in team to apply the concept of information comparison (CIP1) Work in a team to evaluate information from different sources for planning, control and decision-making. |

Value | PCIT1 |

Grades will be determined based on a grading score, calculated using the following assessments and score allocations:

| SKILL | CLO Assessment and Scoring | Weighting for Course Grade | |||||

|---|---|---|---|---|---|---|---|

| Participation | In-class test | Group Project | Midterm | Final Exam | |||

| Describe Management Information (CK1) | 10% | 65% | 10% | 15% | 15% | ||

| Identify Investment and Financing Opportunities (CK2) | 20% | 30% | 20% | 30% | 10% | ||

| Prepare Cost Information (CC1) | 20% | 20% | 30% | 30% | 25% | ||

| Apply Principles of Cash Management and Budgeting (CC2) | 10% | 35% | 30% | 25% | 10% | ||

| Evaluate Costs of an Organization (CCIT1) | 10% | 35% | 30% | 25% | 20% | ||

| Work in team to apply the concept of information comparison (CIP1) | 100% | 20% | |||||

This course primarily involves lecture and problem solving. Open interaction between the lecturer and students is observed. Students are given a lecture plan as a guide for their advance readings. Copies of the presentation are given before the start of the class. Students are given seat works to practice solving the given problems. The last part of the presentation is review questions to be answered by the students individually (and allow them to show their solutions on the board.) Pop quiz is given at the end of the topic.

During the course there is one assignment:

| Assignment: | Company Cost Management and Comparisons (CK1, CIP2) |

| Work Group: | Group |

| Output format: | APA Format Report, Presentation |

| Language: | English |

| Description: |

The assignment will require students to work in groups of 2-5 to research on how companies make comparisons of current actual costs and revenues with information from different sources (e.g. budget/forecast data, previous/corresponding periods, standard costs, competitors, etc.). To do this, the students are required to interview a company and explain the purpose of making information comparison, explain the process of collecting information, identify the bases for comparison, describe how variances are calculated and analyze, and identify control actions considered to correct variances. Assignment Rubric: |

The course targets the 50 lessons in the study plan below. Each lesson is 1.5 class hours each; there are a total of 75 class hours. The study plan below describes the learning outcome for each lesson, described in terms of what the student should be able to do at the end of the lesson. Readings should be done by students as preparation before the start of each class. Implementation of this study plan may vary somewhat depending on the progress and needs of students.

| Lesson Learning Outcomes | Teaching and Learning Activities, Assessment | |||

|---|---|---|---|---|

| 1 |

Management information

|

Lecture (T) Exam type questions practice (A) Quizziz (A) | ||

| 2 |

Management information (continued)

|

Lecture (T) Exam type questions practice (A) Quizziz (A) | ||

| 3 |

The role of information technology

|

Lecture (T) Exam type questions practice (A) Demonstration and discussion (T) Homework (A) Quiz (A) Quizziz (A) | ||

| 4 |

Cost classification

|

Lecture (T) Exam type questions practice (A) Demonstration and discussion (T) Homework (A) Quiz (A) Quizziz (A) | ||

| 5 |

Cost classification (continued)

|

Demonstration of total cost calculation (T) Exam-type questions practice (A) | ||

| 6 |

Cost behavior

|

Lecture (T) Exam type questions practice (A) Demonstration and discussion (T) Quiz (A) Kahoot! (A) | ||

| 7 |

Information for Comparisons

|

Lecture (T) Exam type questions practice (A) Demonstration and discussion (T) Group exercise (A) Group Project (A) | ||

| 8 |

Information for Comparisons (continued)

|

Lecture (T) Discuss and demonstrate sales variance calculation (T) Exam-type questions practice (A) | ||

| 9 |

Information for Comparisons (continued)

|

Lecture (T) Discuss and demonstrate cost variance calculation (T) Exam-type questions practice (A) Quizziz (A) Quiz (A) | ||

| 10 |

Reporting Management Information

|

Lecture (T) Exam type questions practice (A) | ||

| 11 |

Reporting Management Information (continued)

|

Lecture (T) Discussion (T) Exam type questions practice (A) Quizziz (A) | ||

| 12 |

Materials (Part 1)

|

Lecture (T) Exam type questions practice (A) Quiz (A) Quizziz (A) | ||

| 13 |

Materials (Part 1) (continued)

|

Lecture (T) Review of homework questions (A) Exam type questions practice (A) Demonstration and discussion (T) | ||

| 14 |

Materials (Part 2)

|

Lecture (T) Exam type questions practice (A) Demonstration and discussion (T) | ||

| 15 |

Materials (Part 2) (continued)

|

Lecture (T) Exam type questions (A) Demonstration and discussion (T) Quiz (A) | ||

| 16 |

Labour

|

Lecture (T) Exam type questions (A) Quizziz (A) | ||

| 17 |

Labour (continued)

|

Lecture (T) Discussion and demonstration (T) Group discussion (A) Quizziz (A) | ||

| 18 |

Labour (continued)

|

Lecture (T) Demonstrate and discuss labour ratios calculation (T) Quiz (A) | ||

| 19 |

Expenses

|

Lecture (T) Discussion types of business expenses (T) Exam type questions practice (A) | ||

| 20 |

Expenses (continued)

|

Lecture (T) Exam type questions (A) Demonstrate depreciation calculation using different methods (T) Quizziz (A) Quiz (A) | ||

| 21 |

Overheads and absorption costing

|

Lecture (T) Exam type questions practice (A) Demonstration and discussion (T) Quizziz (A) | ||

| 22 |

Overheads and absorption costing (continued)

|

Lecture (T) Exam type questions practice (A) Demonstration and discussion (T) | ||

| 23 |

Overheads and absorption costing (continued)

|

Lecture (T) Exam type questions practice (A) Demonstration and discussion (T) Quiz (A) | ||

| 24 |

Marginal costing and absorption costing

|

Lecture (T) Exam type questions practice (A) Demonstration and discussion (T) Quizziz (A) | ||

| 25 |

Marginal costing and absorption costing

|

Lecture (T) Exam type questions practice (A) Demonstrate profit reconciliation (T) Quiz (A) | ||

| 26 |

Cost bookkeeping

|

Lecture (T) Exam type questions (A) Demonstration and Group discussion (T) Quiz (A) | ||

| 27 |

Job, batch and service costing

|

Lecture (T) Discussion of different costing methods (T) Demonstrate calculation of total cost of the job and batch unit costs (T) Exam type questions practice (A) Homework (A) | ||

| 28 |

Job, batch and service costing (continued)

|

Lecture (T) Discuss the use of service costing (T) Demonstrate calculation of total service costs and service unit costs (T) Exam type questions practice (A) Quizziz (A) Quiz (A) | ||

| 29 |

Process Costing – Part 1

|

Lecture (T) Short video on how products build-up cost in manufacturing (T) Demonstrate calculation of normal losses. (T) Exam type questions practice (A) Homework (A) | ||

| 30 |

Process Costing – Part 1 (continnued)

|

Lecture (T) Demonstrate calculation of normal and abnormal losses/gains (T) Exam type questions practice (A) Homework (A) | ||

| 31 |

Process Costing – Part 2

|

Lecture (T) Demonstrate calculation of joint costs (T) Exam type questions practice (A) Group discussion (A) Quizziz (A) Quiz (A) | ||

| 32 |

Cost-Volume-Profit Analysis (CVP)

|

Lecture (T) Demonstrate calculation of C/S ratio, BEP, and MOS (T) Exam type questions practice (A) Homework (A) | ||

| 33 |

Cost-Volume-Profit Analysis (CVP) (continued)

|

Lecture (T) Demonstrate the calculation of target profit (T) Discuss CVP charts (break-even, P/V and contribution break-even) (T) Exam type questions (A) Quiz (A) | ||

| 34 |

Short-term decisions (Part 1)

|

Lecture (T) Discuss and demonstrate calculation of limiting factor (materials, labour, and overheads) (T) Exam type questions practice(A) Kahoot! (A) | ||

| 35 |

Short-term decisions (Part 2)

|

Lecture (T) Demonstrate the determination of an optimal product solution (T) Exam type questions practice (A) Homework (A) | ||

| 36 |

Short-term decisions (Part 3)

|

Lecture (T) Demonstrate solving a make/buy-in problems (T) Exam type questions practice (A) Homework (A) Quiz (A) | ||

| 37 |

Capital investment appraisal – Part 1

|

Lecture (T) Discuss and demonstrate calculation of interest rates (T) Demonstrate calculation of annuity and perpetuity (T) Exam type questions practice (A) Homework (A) | ||

| 38 |

Capital investment appraisal – Part 2 (continued)

|

Lecture (T) Demonstration of NPV and IRR calculation (T) Exam type questions practice (A) Homework (A) | ||

| 39 |

Capital investment appraisal – Part 3

|

Lecture (T) Demonstrate calculation of simple and discounted payback period (T) Homework (A) Quiz (A) | ||

| 40 |

Cash and Cash flows

|

Lecture (T) Discuss and demonstrate calculation of operational cashflow (T) Exam type questions practice (A) Kahoot! (A) | ||

| 41 |

Cash and Cash flows (continued)

|

Lecture (T) Demonstrate profit statement preparation using cash and accruals accounting (T) Exam type questions practice (A) Quiz (A) | ||

| 42 |

Cash and treasury management

|

Lecture (T) Exam type questions practice (A) Kahoot! (A) | ||

| 43 |

Cash and treasury management (continued)

|

Lecture (T) Exam type questions practice (A) Kahoot! (A) Quiz (A) | ||

| 44 |

Forecasting cash flows (Part 1)

|

Lecture (T) Discuss and demonstrate how to prepare cash receipts and payments budget (T) Exam type questions practice (A) Homework (A) | ||

| 45 |

Forecasting cash flows (Part 2)

|

Lecture (T) Discussion of control procedures for cash deficiency and cash surplus (T) Demonstrate budget preparation with effects of inflation (T) Exam type questions practice (A) | ||

| 46 |

Forecasting cash flows (Part 2) (continued)

|

Lecture (T) Illustrate calculation of moving averages (T) Exam type questions practice (A) Homework (A) Kahoot! (A) Quiz (A) | ||

| 47 |

Investing surplus funds

|

Lecture (T) Discuss various types of investments such as short-term and long-term investments (T) Exam type questions practice (A) Kahoot! (A) Quiz (A) | ||

| 48 |

Raising finance from a bank

|

Lecture (T) Describe the bank lending criteria (T) Discuss the different types of bank financing (T) Exam type questions practice (A) Kahoot! (A) Quiz (A) | ||

| 49 | Review Review and preparation for final exam(All CLOs) | Review practice test questions (A) | ||

| 50 | Review Review and preparation for final exam(All CLOs) | Review practice test questions (A) | ||

| Total Hours: 75 hours | ||||

Textbooks

References