1. COURSE DESCRIPTION

The course teaches students to pull apart financial statements to find relevant information for valuation, identify “red flags” that indicate an impending liquidity crisis, see how industry fundamentals and competitive forces directly affect financial results and drive stock valuation, and value any public or private company for purchase, sale, minority investment, or going concern. learning to assess real estate investments; identify the main drivers of property market value and performance; analyze company valuation expert reports; and ask the “right” questions. Students will learn how to measure the value of a corporation and real estate assets to make reasonable business decisions.

2. REASON FOR THE COURSE

Students will learn about different financial markets and their role in the economy, as well as current trends in financial markets and institutions, such as innovation and globalization, with a focus on financial institutions, investors, and financial instruments. The course also covers alternative investment methods in global financial markets, including their logic, strategy building, and administration. Students will learn discounted cash flow models, market multiple models, and private firm valuation in stock valuation and real estate valuation (commercial and residential property, Cambodian real estate market). The course is for corporate finance, investment banking, security analysis, consulting, and private equity students who want to apply valuation methods in real life. Students will also study the CFA Institute Code of Ethics and Standards of Professional Conduct, characterize the sustainability landscape, and examine sustainable technologies, strategies, and business models from managers, entrepreneurs, and investors’ perspectives.

3. STUDY HOURS

4. ROLE IN CURRICULUM

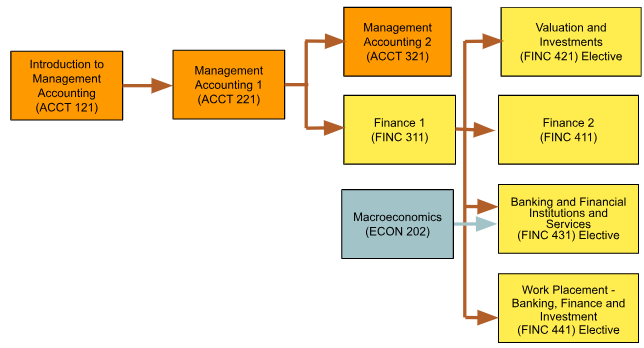

Prerequisites:

Students must have completed Finance 1 (FINC 311) before attempting this course.

Upon successful completion of this course, students should be able to:

| Knowledge |

Level of Learning |

Related PLO |

|---|---|---|

| Explain investment fundamentals (CK1) Explain investment fundamentals, focusing on financial markets and institutions, global financial market alternatives, and investor strategies based on their goals. |

Understand | PC1 |

| Explain valuation method of equity and real estate (CK2) Explain how to appraise and manage equity and real estate investments and the factors affecting their value. |

Understand | PC1 |

| Cognitive Skills |

Level of Learning |

Related PLO |

| Evaluation of equity investment (CC1) Evaluate equity investment risk and return and equity valuation models for listed and private companies using real-world data |

Evaluate | PC1 |

| Evaluation of real estate investment (CC2) Evaluate different models for the real estate valuation of commercial and residential properties, considering issues that impact the valuation |

Evaluate | PC1 |

| Communication, Information Technology, and Numerical Skills |

Level of Learning |

Related PLO |

| Produce an equity and real estate valuation (CCIT1) Produce equity and real estate valuation using Microsoft Excel software |

Create | PCIT2 |

| Interpersonal Skills and Responsibilities |

Level of Learning |

Related PLO |

| Work ethically (CIP2) Apply ethical behavior as an investment professional in accordance with the CFA Code of Ethics. |

Apply | PIP2 |

Grades will be determined based on a grading score, calculated using the following assessments and score allocations:

| Topic | CLO Assessment and Scoring | Skill Weighting for Grade |

|||||

|---|---|---|---|---|---|---|---|

| Participation | In-class test | Project | Midterm Exam | Final Exam | |||

| Explain investment fundamentals (CK1) | 20% | 50% | 30% | 15% | |||

| Explain valuation methods of equity and real estate (CK2) | 20% | 40% | 40% | 30% | |||

| Evaluation of equity investment (CC1) | 70% | 30% | 30% | ||||

| Evaluation of real estate investment (CC2) | 30% | 70% | 10% | ||||

| Produce an equity and real estate valuation (CCIT1) | 40% | 30% | 30% | 5% | |||

| Work Ethically (CIP1) | 100% | 10% | |||||

The course will be delivered as a mix of lectures, class discussion, practice assignments, and cases. Some of the questions on the midterm and final exams will be based on real-life financial statements of well-known companies.

Class participation grade will be based both on attendance and constructive participation. You are expected to participate in class discussions, and you will be graded on your contribution to the classroom learning environment. You should expect to be “cold called” to discuss assigned review problems and to offer views on the assigned material.

During the term, there is one project assignment.

| Assignment: | Business Valuation (CC1, CCIT1 & CIP1) |

| Work Group: | Group of 3-4 |

| Output format: | Professional Valuation Report Format, Presentation |

| Language: | English |

|

Phase 1: Description: |

Each team must prepare a written research report on the subject company (the subject company can be ABC, PWSA, PPAP, PAS, GTI, PPSEZ, PEPC, or NagaCorp) chosen by the team, which involves an analysis of the ordinary shares of a publicly listed company. Each team will be required to value the equity of the chosen company. Each student will be tested on their analytical, valuation, report writing, and presentation skills. |

| Phase 2: Description: | This phase requires each team to value a property in Cambodia. A detailed analysis of the local real estate market condition is the starting point. In addition, you need to predict the future cash flow generated from the asset and use the discount cash flow model to value the property. The quality of the report, the quality of the analysis, and the logical reasoning in developing the analysis are the key factors for the assessment. Assignment Rubric: |

The course targets the 50 lessons in the study plan below. Each lesson is 1.5 class hours each; there are a total of 75 class hours. The study plan below describes the learning outcome for each lesson, described in terms of what the student should be able to do at the end of the lesson. Readings should be done by students as preparation before the start of each class. Implementation of this study plan may vary depending on the progress and needs of students.

| Lesson Learning Outcomes | Teaching and Learning Activities, Assessment | |||

|---|---|---|---|---|

| 1 |

Introduction to the Investment Setting

|

Lecture Reading: |

||

| 2 |

Introduction to the Investment Setting

|

Lecture Reading: |

||

| 3 |

Introduction to the Investment Setting

|

Lecture Reading: |

||

| 4 |

Introduction to the Investment Setting

|

Lecture Reading: |

||

| 5 |

Introduction to Alternative Investments

|

Lecture Reading: |

||

| 6 |

Introduction to Alternative Investments

|

Lecture Reading: |

||

| 7 |

Investment risk and return

|

Lecture Reading: |

||

| 8 |

Legal Personality of Company (3)

|

Lecture Reading: |

||

| 9 |

Investment risk and return

|

Lecture Reading: |

||

| 10 |

Investment risk and return

|

Lecture Reading: |

||

| 11 |

Investment risk and return

|

Lecture Reading: |

||

| 12 |

Introduction to Valuation

|

Lecture Reading: Khan Academy: Interest & Debt (Videos 5-8) |

||

| 13 |

Introduction to Valuation

|

Lecture Reading: Khan Academy: Interest & Debt (Videos 5-8) |

||

| 14 |

Discounted Dividend Valuation

|

Lecture Reading: Khan Academy: Stocks and bonds (Videos 1-2, 7-12) |

||

| 15 |

Discounted Dividend Valuation

|

Lecture Reading: Khan Academy: Stocks and bonds (Videos 1-2, 7-12) |

||

| 16 |

Discounted Dividend Valuation

|

Lecture Reading: Khan Academy: Stocks and bonds (Videos 1-2, 7-12) |

||

| 17 |

Free Cash Flow Valuation

|

Lecture Reading: Khan Academy: Stocks and bonds (Videos 16-17) |

||

| 18 |

Free Cash Flow Valuation

|

Lecture Reading: Khan Academy: Stocks and bonds (Videos 16-17) |

||

| 19 |

Free Cash Flow Valuation

|

Lecture Reading: Khan Academy: Stocks and bonds (Videos 16-17) |

||

| 20 |

Multiples Valuation

|

Lecture Reading: |

||

| 21 |

Multiples Valuation

|

Lecture Reading: |

||

| 22 |

Multiples Valuation

|

Lecture Reading: |

||

| 23 |

Valuing private company

|

Lecture Reading: Khan Academy: Stocks and bonds (Videos 16-17) |

||

| 24 |

Valuing private company

|

Lecture Reading: Khan Academy: Stocks and bonds (Videos 16-17) |

||

| 25 |

Valuing private company

|

Lecture Reading: Khan Academy: Stocks and bonds (Videos 16-17) |

||

| 26 |

IPO Valuation

|

Lecture Reading: Khan Academy: Stocks and bonds (Videos 16-17) |

||

| 27 |

IPO Valuation

|

Lecture Reading: Khan Academy: Stocks and bonds (Videos 16-17) |

||

| 28 |

Real Estate Valuation

|

Lecture Reading: |

||

| 29 |

Real Estate Valuation

|

Lecture Reading: |

||

| 30 |

Real Estate Valuation

|

Lecture Reading: |

||

| 31 |

Team Exercise: Multiples Valuation

|

Brief lecture |

||

| 32 |

Team Exercise: Multiples Valuation

|

Brief lecture |

||

| 33 |

Team Exercise: Multiples Valuation

|

Brief lecture |

||

| 34 |

Team Exercise: Forecasting Performance

|

Brief lecture |

||

| 35 |

Team Exercise: Forecasting Performance

|

Brief lecture |

||

| 36 |

Team Exercise: Forecasting Performance

|

Brief lecture |

||

| 37 |

Team Exercise: Estimating WACC

|

Brief lecture |

||

| 38 |

Team Exercise: Estimating WACC

|

Brief lecture |

||

| 39 |

Team Exercise: Estimating WACC

|

Brief lecture |

||

| 40 |

Team Exercise: Calculating FCFF and MVE

|

Brief lecture Examples of FCFF and MVE calculation Mini-presentation and discussion |

||

| 41 |

Team Exercise: Calculating FCFF and MVE

|

Brief lecture |

||

| 42 |

Team Exercise: Calculating FCFF and MVE

|

Brief lecture |

||

| 43 |

Team Exercise: Sensitivity Analysis

|

Brief lecture |

||

| 44 |

Team Exercise: Sensitivity Analysis

|

Brief lecture |

||

| 45 |

Team Presentations – Complete Report (CK2, CC2, CCIT1, CIP1) |

Team presentations and feedback | ||

| 46 |

Team Presentations – Complete Report (CK2, CC2, CCIT1, CIP1) |

Team presentations and feedback | ||

| 47 |

Team Presentations – Complete Report (CK2, CC2, CCIT1, CIP1) |

Team presentations and feedback |

||

| 48 |

Team Presentations – Complete Report (CK2, CC2, CCIT1, CIP1) |

Team presentations and feedback |

||

| 49 |

CFA Code of Ethics

|

Lecture Reading: |

||

| 50 |

Global Investment Performance Standards (GIPS)

|

Lecture Reading: |

||

| Total Hours 75 hours | ||||

Textbooks

Additional References

Note: A financial calculator capable of performing operations with amortizing payments and uneven cash flows (e.g., Texas Instruments BA II Pus, Hewlett Packard 12C, etc.). You could use an app on your smartphone but it will not be allowed during exams. Please bring your calculator to each class.