1. COURSE DESCRIPTION

This course covers a number of tasks that are divided into two parts. The first part is the professional orientation which focuses on understanding the work environment of prospective employers and the job markets in general. After this, the students will be placed at the selected employers where they will apply their acquired knowledge, skills, and attitude in a real work environment. It is essential for the students to comply with the hosting organization’s requirements, to meet the Performance Objectives (POs), and to keep track of their training progression throughout the work placement period.

2. REASON FOR THE COURSE

Students must develop practical knowledge, skills, and attitudes in order to strengthen their positions in the market. They need an opportunity to apply the knowledge acquired in previous coursework in a real business setting. Therefore, program graduates will develop work-readiness skills and be familiar with the key factors for success in a tax career.

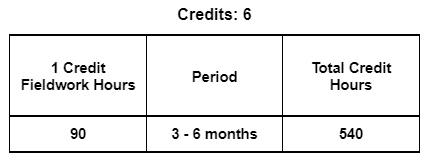

3. STUDY HOURS

4. ROLE IN CURRICULUM

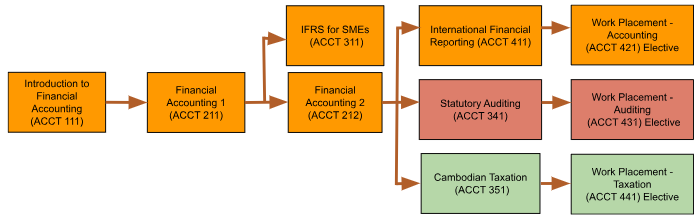

Prerequisites:

On successful completion of this course, students will be able to:

| Knowledge | Level of Learning |

Related PLO |

|---|---|---|

| Identify Tax Issues and Ethics (CK1) Identify the general tax issues and ethical requirements in relation to tax law and regulations. |

Understand | PIP2 |

| Cognitive Skills | Level of Learning |

Related PLO |

| Compute Tax Liabilities (CC1) Compute the liabilities and tax payments in accordance with the tax law and regulations. |

Apply | PC3 |

| Assess the Implication of Non-Compliance (CC2) Assess the implication of non-compliance and tax planning in accordance with tax regulations. |

Create | PC3 |

| Communication, Information Technology, and Numerical Skills | Level of Learning |

Related PLO |

| Discuss Tax Risks and Minimization Measures (CCIT1) Discuss the potential tax risks and/or tax minimization measures for individuals and organizations. |

Apply | PCIT3 |

| Interpersonal Skills and Responsibilities | Level of Learning |

Related PLO |

| Work Effectively (CIP1) Work effectively with the team to deal with relevant tax issues of individuals and organizations. |

Characterize | PIP1 |

Grades will be determined based on the following assessments and score allocations:

| SKILL | Assessment | Skill Weighting for Grade | ||||

|---|---|---|---|---|---|---|

| Mentor | Supervisor | Peer | PE Report | |||

| Identify Tax Issues and Ethics (CK1) | 50% | 50% | 10% | |||

| Compute Tax Liabilities (CC1) | 50% | 50% | 30% | |||

| Assess the Implication of Non-Compliance (CC2) | 50% | 50% | 30% | |||

| Discuss Tax Risks and Minimization Measures (CCIT1) | 50% | 50% | 20% | |||

| Work Effectively (CIP1) | 25% | 50% | 45% | 10% | ||

Performance Objectives

Students are required to achieve a minimum of four performance objectives in total including all three interpersonal qualities and the core skills of performance objectives in Tax.

Students may achieve each performance objective by participating in the suggested activities or other similar activities related to the performance objectives by providing an explanation in the practical experience report.

The performance objectives are set out in interpersonal qualities and core skills as in Appendix 1.

To provide evidence of achieving performance objectives, students are required to request a confirmation letter from their supervisor with the attachment of the performance objectives that they have achieved during the job training.

| Report: | Personal Experience Report |

| Work Group: | Individual |

| Output format: | Performance Objective Matrix |

| Language: | English |

|

Description: |

Students will be required to produce a summarized report reflecting the experience obtained from the job training that satisfies the required performance objectives. As their training progresses, students should keep track of their experiences. At the end of the training, students will be required to write a report summarizing the experience in their own words in a performance objective matrix. The report should be clear and truthfully reflect the experience with examples provided. |

| Lesson Learning Outcomes |

Teaching (T), and |

|

|---|---|---|

| 1 |

Course Orientation

|

Lecture Question and Answer |

| 2-18 | On-Job training (All CLOs) | Apply knowledge |

ACCA Rule Book https://www.accaglobal.com/gb/en/about-us/regulation/ethics/acca-rulebook.html

ACCA Performance Objectives

https://www.accaglobal.com/vn/en/student/practical-experience-per/performance-objectives.html

Appendix 1 – Performance Objectives

Interpersonal Qualities

These are the important elements of interpersonal qualities that students must achieve. They are required to maintain a professional code of ethics, develop productive business relationships with stakeholders, and take initiative as a leader during work.

| Performance Objectives | Elements |

| Maintain a professional code of ethics |

|

| Develop productive business relationships |

|

| Apply leadership and self-development |

|

Core Skill

Tax

Students will be involved in planning the tax assessments and computing the relevant tax liabilities in accordance with the laws and regulations. They could represent the business to prepare and file the tax return and advise the business on the tax planning.

| Performance Objectives | Elements |

| Calculate and assess tax liabilities |

|

| Verify and assess tax compliance |

|

| Plan and advise on tax |

|